For the duration of these hard economic instances, how do employers discover a balance between saving cash and presenting employees a complete benefit bundle? Many employers are turning to voluntary benefits.

For the duration of these hard economic instances, how do employers discover a balance between saving cash and presenting employees a complete benefit bundle? Many employers are turning to voluntary benefits.

Voluntary benefits are benefits made to be had to employees and paid completely by way of personnel. Voluntary benefits offer fee for both the agency and the worker. The employer has a fee-effective manner to provide extra advantages for his or her personnel and employees have a convenient and more inexpensive way to buy coverage. Coverage including dental, vision, lifestyles, disability, etc. In a few cases, voluntary benefits are used to bridge the gap of the higher deductibles many employers are supplying to their personnel.

Employers that offer voluntary benefits seem like more targeted on their personnel. Consequences from Prudential’s 6th Annual Study of Employee Benefits: Today & Beyond are in and they imply that employers that offer voluntary benefits are employee-targeted, as opposed to fee-pushed. The study found that 85% of employers say they offer one or greater voluntary benefits, while nearly 1/2 provide four or extra.

Why are employers offering voluntary benefits? The study discovered that 75% of employers say their pinnacle cause for presenting voluntary benefits is to amplify the benefits alternatives to be had to their employees, while 42% offer voluntary benefits to fulfill a workers want and 30% provide them because they have been requested. Of these which have been gauging the achievement in their voluntary benefits software, 76% say that worker satisfaction with the advantage plan has stepped forward.

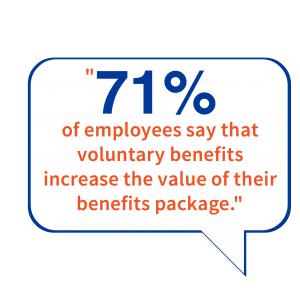

Employees recognize being able to buy voluntary benefits through their workplace and 80% consider that the place of work is an important source to purchase non-public and coverage financial savings merchandise. More than half of employees (52%) experience that offering voluntary benefits will increase the value in their organization’s services, further to giving them a truthful choice this is also handy because charges are paid through payroll deductions. 30% of employees that purchased life insurance merchandise via their agency said they did so virtually, because the product had been offered to them at work.

Employees also feel that buying products through their job is a more trustworthy alternative and that the service names presented are vital. More than half of (51%) of individuals consider the provider call to be essential while determining whether or not to join voluntary alternatives.