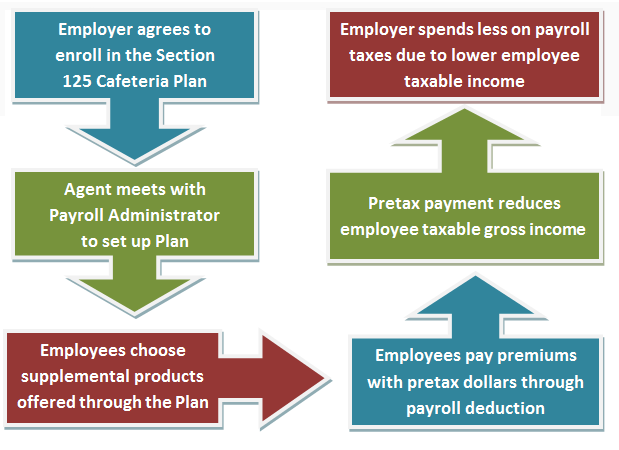

Made possible by section 125 of the IRS code, these plans offer employers a way to save taxes on their group benefit plans and offer employees a way to save taxes on money spent out-of-pocket for dependent care and medical expenses.

Made possible by section 125 of the IRS code, these plans offer employers a way to save taxes on their group benefit plans and offer employees a way to save taxes on money spent out-of-pocket for dependent care and medical expenses.

Three types of Section 125 plans exist: Premium Only, Flexible Spending Accounts, and Full Cafeteria Plan. Money allocated to a Section 125 Plan is subtracted from the employee’s taxable income. It is also free from employer-paid Social Security and Unemployment taxes.

Benefit plans may include:

- Flexible contribution amounts

- Plan documentation for employees

- Weekly employee reimbursement cycle

- Annual re-enrollment process

What is Section 125?

Section 125 is compatible with cafeteria plans. Cafeteria plans can be used beneath two categories: premium only plans (POP) and flexible spending accounts (FSA). In a nutshell, cafeteria plans are a part of a worker benefits program that is to be had for small companies. It permits employees to allocate a portion of their pre-tax earnings to cover numerous clinical costs, for each themselves as well as dependents. normally, POPs and FSAs are used to cover fees that insurance does not cover. With the aid of setting money into either of the accounts owed, employees can shop on the quantity of taxes they pay on their income.

Here’s the seize: section 125 isn’t widely publicized therefore a lot of small businesses do not understand they are able to use this as part of the tax code to increase worker advantages and growth margins for the enterprise. However, now you’re in on the secret.

What’s the premium simplest Plan (POP)?

Because the name states, this plan gives personnel the ability to pay for coverage rates with pre-tax dollars. Eligible prices range from prescriptions to dental rates to Medicare supplements.

What is a flexible Spending Account (FSA)?

Much like a POP, with an FSA, you can designate a specific amount of pre-tax money into an account this is used for medical expenses for each employees and their dependents. The finances in this account can be used to cover out-of-pocket costs. On common, employees can store among 20 and forty percent on based expenses by taking advantage of an FSA. Small commercial enterprise proprietors also can make contributions to worker FSAs to acquire tax savings as well.

How does it all work?

Budget allocated to cafeteria plans are eligible to cover expenses for 365 days. The specific plan year is protected in your plan description. At the start of every plan 12 months, personnel are able to allocate a percent (or a specific quantity) of their income to cover out-of-pocket prices.

One essential aspect to recall: these plans perform on a “use it or lose it” basis, that means any unused price range are forfeited at the give up of a plan 12 months. So it’s far critical for employees to not overestimate the amount of funds they need to set aside.

That being stated, there may be a 75-day grace length in order that employees can use their last price range on the quit of each plan (meaning personnel have a further seventy five days to apply cafeteria plan budget after the end of the plan year.) Especially, with FSAs, a carryover provision carried out in 2013 wherein employees can carryover up to $500 of FSA funds from one plan 12 months to the subsequent.